XRP Price Prediction: How High Will It Go Amid Market Volatility?

#XRP

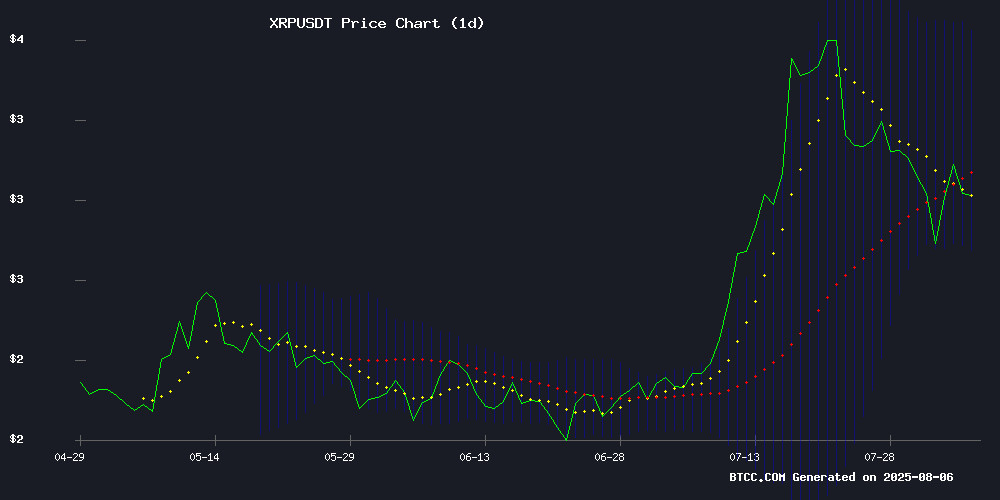

- XRP is currently trading below its 20-day moving average, indicating potential resistance at 3.1650 USDT.

- Strategic partnerships and regulatory challenges are creating mixed market sentiment.

- A breakout above the 20-day MA could push XRP toward the upper Bollinger Band at 3.5859 USDT.

XRP Price Prediction

XRP Technical Analysis: Key Indicators to Watch

According to BTCC financial analyst Mia, XRP is currently trading at 2.9466 USDT, below its 20-day moving average of 3.1650. The MACD indicator shows a slight positive momentum with a value of 0.2162, while the Bollinger Bands suggest a potential range between 2.7441 (lower band) and 3.5859 (upper band). Mia notes that the price is facing resistance NEAR the 20-day MA, and a breakout above this level could signal a bullish trend.

XRP Market Sentiment: Mixed Reactions Amid Strategic Developments

BTCC financial analyst Mia highlights the mixed sentiment surrounding XRP. Positive developments include Ripple's strategic partnerships, such as the cloud mining collaboration with Winner Mining and custody services launch in South Korea. However, concerns linger due to regulatory challenges and a recent 4.2% price drop. Mia emphasizes that these factors could create volatility in the short term but may bolster long-term growth.

Factors Influencing XRP’s Price

Ripple's XRP Enables Real-Time Transactions Amid Strategic Cloud Mining Partnership

Ripple's XRP ledger has achieved a breakthrough in transaction settlement times, reducing cross-chain transfers from 10-30 minutes to under 60 seconds. The upgrade reinforces XRP's position as a bridge currency for frictionless value transfer between fiat and cryptocurrencies.

PaladinMining CEO John Alexander revealed a cloud mining partnership that claims to generate $8,000 daily yields. The collaboration focuses on liquidity optimization and chain abstraction, though such high-yield promises warrant scrutiny given the unregulated nature of cloud mining operations.

Ripple's consensus mechanism continues to challenge traditional settlement systems by eliminating intermediaries. The network's native XRP token remains pivotal to its vision of reshaping global money flows, particularly for institutional payment corridors.

Winner Mining Launches XRP Passive Income Contracts with $5,000 Daily Earnings Potential

Winner Mining, a global cloud mining platform, has introduced its XRP Passive Income Contract, promising investors daily returns of up to $5,000. The offering capitalizes on Ripple's growing market confidence, positioning XRP as a leading asset for passive income generation.

The contract leverages Winner Mining's network of 150,000 high-performance mining machines across 84 green energy facilities worldwide. Designed for automated returns, it emphasizes accessibility and sustainable profitability. "This expansion reflects our commitment to passive income solutions," a company spokesperson noted, framing the launch as an evolution of their hands-off earnings philosophy.

Cloud mining services like Winner Mining's allow cryptocurrency exposure without hardware ownership. The platform requires only email registration to begin mining operations, though the article's promotional claims about earnings potential warrant scrutiny given typical cloud mining risks.

Ripple and BDACS Launch XRP Custody Services in South Korea

BDACS, a regulated cryptocurrency custodian in South Korea, has officially begun offering custody support for XRP, marking a significant milestone in its partnership with Ripple. The collaboration, announced earlier this year, aligns with South Korea's Financial Services Commission roadmap to expand institutional participation in digital assets.

XRP, described as one of the most popular digital assets in Korea, is now available for custody and deployment across major local exchanges including Upbit, Coinone, and Korbit. The integration of Ripple Custody's software platform enables secure storage and management of XRP, with future support planned for Ripple's upcoming stablecoin, RLUSD.

This development strengthens Ripple's foothold in the Asian market while providing Korean institutions with regulated access to digital asset services. The custody solution addresses growing demand from institutional players seeking compliant infrastructure for cryptocurrency operations.

Ripple Challenges Draft Crypto Bill Over SEC Jurisdictional Expansion

Ripple has issued a sharp critique of proposed U.S. crypto legislation, warning that the draft bill grants excessive authority to the Securities and Exchange Commission without clear jurisdictional boundaries. The company's Chief Legal Officer Stuart Alderoty contends the current framework fails to distinguish between securities and commodities regulation, potentially subjecting established tokens like XRP to perpetual SEC oversight.

The payments firm advocates for legislative clarity, proposing that digital assets operating on open networks for five years or more should be exempt from securities regulation. Ripple insists Congress—not the SEC—must define Howey Test parameters for crypto assets, arguing that regulatory ambiguity ultimately harms consumers and market participants.

At stake is the classification of "ancillary assets" under the proposed bill, which Ripple believes could enable unchecked SEC overreach. The company's intervention highlights growing industry resistance to regulatory frameworks that don't account for the unique characteristics of blockchain-based assets.

XRP Retreats 4.2% as Resistance Holds at $3.04 Amid High-Volume Sell-Off

XRP faced a sharp reversal during the 24-hour session ending August 6, dropping 4.2% from $3.06 to $2.93. The decline was driven by a surge in trading volume, which spiked to 169.41 million—more than three times the 24-hour average of 52.73 million. A key resistance level formed at $3.04, while $2.93 emerged as a temporary support floor.

The sell-off intensified at 14:00, with XRP plunging from $3.04 to $2.97 in a single hour. Late-session action confirmed bearish momentum, as the token slid another 1% in the final hour, hitting fresh intraday lows. Traders are now watching the $2.93-$3.04 range for signs of consolidation or further downside.

Ex-SEC Lawyer Clarifies Ripple's $125M Fine Status Amid XRP Lawsuit Speculation

As the Ripple vs. SEC case approaches a critical August 15 deadline, misinformation swirls regarding the $125 million penalty. Contrary to social media claims, former SEC attorney Marc Fagel confirms Ripple has not paid the fine—funds remain in escrow pending appeal resolutions.

The escrow mechanism, controlled by Ripple's legal team, ensures payment to the U.S. Treasury only after both parties formally dismiss appeals. This procedural clarity comes amid heightened scrutiny of Judge Analisa Torres' ruling and the SEC's next moves.

Ripple Engages in U.S. Crypto Legislation Drafting Process

Ripple has formally responded to the U.S. Senate Banking Committee's request for input on proposed cryptocurrency market structure legislation. The company's Chief Legal Officer, Stuart Alderoty, highlighted Ripple's decade of regulatory experience worldwide as foundational to their contributions.

The draft legislation represents a pivotal moment for crypto regulation in the United States. Ripple's submission focuses on enhancing the bill's effectiveness and transparency, drawing particularly from their ongoing legal challenges with the SEC. "Our unique perspective can help shape legislation that balances consumer protection with innovation," Alderoty stated in the response.

XRP Price Prediction Today As Analyst Warns of 60% Crash

XRP's recent short-term gains mask a potentially severe downturn, with technical indicators flashing warnings reminiscent of its 2020-2021 collapse. The cryptocurrency now exhibits a bearish divergence on weekly charts—price reaching higher highs while the Relative Strength Index (RSI) trends lower. This pattern preceded a three-month, 60% plunge last time it appeared.

Market observers caution against interpreting intermittent rallies as trend reversals. The asset's current trajectory mirrors January 2024's pre-correction behavior, suggesting history may repeat absent fundamental catalysts. Critical support zones cluster between $2.90-$3.00, with $2.75 acting as secondary defense. A breach could trigger accelerated declines toward lower valuation thresholds.

Ripple’s XRP Now Supported by South Korean Custodian BDACS

Ripple's strategic partnership with BDACS has borne its first fruit, with XRP custody services now live at the South Korean institution. The move marks a significant step in bringing regulated digital asset services to institutional investors in a market where XRP remains exceptionally popular.

BDACS announced the launch via social media on August 5, fulfilling its February commitment to support both XRP and Ripple's upcoming stablecoin RLUSD. The collaboration aligns with South Korea's Financial Services Commission roadmap for expanding institutional participation in digital assets.

The custody solution leverages Ripple's proprietary technology platform, providing secure asset storage tailored for financial institutions. Industry projections cited by BDACS suggest crypto custody could grow into a $16 trillion market by 2030, with tokenized assets potentially representing 10% of global GDP.

XRP Price Prediction: Experts Foresee $1 Million Valuation Amid Ripple's Tokenization Push

Cryptocurrency investor Pumpius has made a staggering prediction that XRP could eventually reach $1 million per coin, citing Ripple's strategic positioning in the tokenized economy. While XRP currently trades around $2, the forecast hinges on its utility as a bridge asset for cross-asset transfers in a future where real-world assets like real estate and carbon credits are digitized.

Ripple's infrastructure developments are laying the groundwork for this vision. The XRP Ledger's XLS-20 and XLS-30 upgrades enable NFT and token issuance, while the company's Central Bank Digital Currency projects in Colombia demonstrate practical applications. These initiatives place XRP at the intersection of traditional finance and blockchain innovation.

The potential scale is astronomical. As the tokenized economy grows toward a projected $1 quadrillion valuation, XRP's role in facilitating seamless transfers between asset classes could drive unprecedented demand. Ripple's early-mover advantage in CBDC implementation further strengthens this thesis.

Flare Network Launches Luminite Wallet to Simplify DeFi Access for XRP Users and Newcomers

Flare Network has unveiled Luminite, a lightweight non-custodial wallet aimed at democratizing decentralized finance (DeFi) access. The solution specifically targets XRP holders and crypto novices by eliminating traditional onboarding friction.

Luminite replaces complex seed phrases with Web2-style authentication via passkeys, biometrics, or email—powered by Turnkey's in-wallet technology. The wallet integrates fiat on-ramps through partners like Topper, bridging traditional finance with crypto ecosystems.

As the first native DeFi yield wallet on Flare, Luminite enables asset swapping, staking, and bridging while maintaining institutional-grade security. The launch marks a strategic expansion of Flare's data-centric blockchain infrastructure into user-facing applications.

How High Will XRP Price Go?

BTCC financial analyst Mia provides a cautious yet optimistic outlook for XRP. Based on technical and fundamental analysis, Mia suggests that XRP could test the upper Bollinger Band at 3.5859 USDT if it breaks above the 20-day MA. However, regulatory uncertainties and market sentiment may cap gains in the near term.

| Indicator | Value |

|---|---|

| Current Price | 2.9466 USDT |

| 20-day MA | 3.1650 USDT |

| Bollinger Bands (Upper) | 3.5859 USDT |

| Bollinger Bands (Lower) | 2.7441 USDT |

| Indicator | Value |

|---|---|

| Current Price | 2.9466 USDT |

| 20-day MA | 3.1650 USDT |

| Bollinger Bands (Upper) | 3.5859 USDT |

| Bollinger Bands (Lower) | 2.7441 USDT |